Throughout the world, leasing is a popular form of car financing because it has relaxed qualification requirements, allows for a relatively low monthly payment and lets the consumer have access to a new-model motor vehicle with robust features on a regular basis. In Australia, consumers also have the option of a novated lease, and determining if that type of lease is the ideal long-term financial option is often difficult.

Throughout the world, leasing is a popular form of car financing because it has relaxed qualification requirements, allows for a relatively low monthly payment and lets the consumer have access to a new-model motor vehicle with robust features on a regular basis. In Australia, consumers also have the option of a novated lease, and determining if that type of lease is the ideal long-term financial option is often difficult.

What is a Novated Lease?

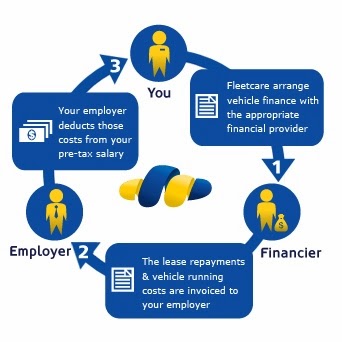

A conventional lease is a financial agreement between two parties, generally the consumer and a bank or other financial institution. A novated lease, on the hand, involves three parties: the consumer, the consumer’s employer and a bank or other financial situation. In other words, novated leasing is a financing option that allows an employer to lease a vehicle on behalf of an employee. The responsibility of the lease remains with the consumer. The primary difference is that the employer automatically makes the lease payments by deducting the necessary sum from the employee’s pay packet.

To Buy or Lease

Before determining if novated leasing is the right option, the consumer should first decide if buying makes more sense. Many people take great pride in ownership, particularly with large purchases like cars, and that is something leasing cannot provide. Owning also provides the consumer with complete control to make choices about the vehicle. Additionally, and perhaps more importantly, owning a vehicle can be more economical over periods beyond three years. There are many factors in play here, however, and leasing is a more consistent and reliable financial option for a wide range of people.

General Leasing: Pros and Cons

When buying a car, the monthly payments are high, relative to the overall cost of the vehicle, and the consumer is on the hook for all maintenance and repairs. Most vehicle leases have a two-or-three-year term, which means that the monthly payment is considerably lower. Typically, a lease covers all repairs and most regular maintenance. Reading the fine print is crucial, however, and a lease that places that burden on the consumer is unlikely to be a better option than purchasing outright. Lastly, the leasing consumer always has the benefit of the reliability and modern feature set that comes with driving a new-model vehicle.

Advantages of a Novated Lease

Novated leases provide a wide range of benefits on top of the benefits of a conventional lease, including:

- Lower qualification requirements

- Pre-tax deduction for lease payment

- All running costs included

With novated leases, consumers with bad credit and no credit at all are not only able to achieve financing but also get it at a more favourable rate than would otherwise be possible. In addition, the employer removes the monthly lease payment from the pay packet prior to calculating taxes, which reduces costs for the consumer further. The employer also removes all running costs prior to taxes, and it may cover some of those running costs as a way to reduce its fringe benefits tax (FBT).

Disadvantages of a Novated Lease

Novated leases are not without their drawbacks. Perhaps the most common disadvantage is that the consumer will have limited options and lose the ability to negotiate. Consumers generally will not pay full sticker price, but they usually cannot get the lease at as low a price as would have been possible on their own. It is also very important that a consumer fully understand the tax ramifications for his or her individual situation. The tax advantages are one of the great benefits associated with novated leases, but the tax laws are murky and not always as consumer friendly as they seem on the surface. Lastly, if loss of employment occurs for any reason, the lease falls back on the consumer with all of the disadvantages and none of the benefits.

Is Novated Leasing for Me?

To determine if novated leasing is the best financial option long term, consumers should objectively assess how leasing in general applies to their situation. Leasing is an effective option for the driver who prefers a new vehicle every three years or so. Consumers must then determine how confident they are in their current employment. Novated leases can be a big risk in certain scenarios, such as when an employee is new, there is an economic recession and when the company or industry is cutting back. Finally, the consumer should take the novated leasing agreement to a tax advisor who can assess it and outline precisely what the tax advantages will be in that specific financial scenario.

Here are a few novated leasing companies in Australia:

http://novatedlease.fleetcare.com.au/

http://www.supalease.com.au/

http://www.esanda.com/personal/car-finance/novated-lease/

http://www.autopia.com.au/

http://www.simplylease.com.au/

Conclusion

Novated leasing is one of the most affordable car ownership options available in Australia, but their effectiveness varies bases on a wide array of factors. Therefore, it’s very important that consumers don’t rush in, but instead, evaluate the advantages and disadvantages for them specifically. Pay particular attention to the real tax benefits, and then determine if those offset any disadvantages.

This piece was written by freelance writer, Monica Flintoff. Connect with Monica on Google+.

References

http://en.wikipedia.org/wiki/Novated_lease

http://www.edmunds.com/car-leasing/

http://www.taxpayer.com.au